Crisis Financial loans: Your Brief Economical Lifeline in Situations of Disaster

Daily life is usually unpredictable, and unanticipated charges typically arise whenever we the very least count on them. Whether or not it’s a medical unexpected emergency, unexpected automobile repairs, or an urgent dwelling fix, financial crises can throw even quite possibly the most organized finances into disarray. That’s exactly where unexpected emergency financial loans are available as being a trusted and fast fiscal solution.

Precisely what is an Crisis Loan?

An unexpected emergency bank loan is usually a kind of limited-expression funding designed to aid men and women deal with urgent, unexpected fees. These financial loans are generally straightforward to submit an application for and have speedy acceptance times, creating them ideal for time-delicate cases.

Types of Crisis Financial loans

There are plenty of types of crisis financial loans to take into account, Just about every catering to unique demands:

Personalized Loans: Made available from financial institutions, credit rating unions, and on the web lenders, private financial loans can be employed for a range of needs, like emergencies. They usually have fastened curiosity rates and repayment conditions.

Payday Loans: These are definitely limited-term financial loans that have to be repaid by your subsequent paycheck. Though They can be easy to qualify for, they generally include significant curiosity fees.

Bank card Hard cash Improvements: If you have a bank card, you could withdraw income nearly a certain limit. Having said that, interest costs on hard cash developments are usually bigger than typical buys.

Pawn Store Loans: These loans call for you to provide an product of value as collateral. The mortgage volume relies on the value in the merchandise, and you will retrieve your product once the mortgage is repaid.

The best way to Qualify for an Unexpected emergency Financial loan

The qualification conditions change based on the lender and type of bank loan, but commonly, you’ll will need:

Evidence of profits or work.

A legitimate ID and Social Protection range.

An honest credit rating score (even though some lenders offer you choices for People with very poor credit rating).

On the web lenders typically provide a seamless application process, with many approving financial loans in just a several hrs or the following company working day.

Benefits and drawbacks of Crisis Loans

Pros:

Brief Use of Money: Many lenders deliver similar-day or subsequent-working day funding.

Versatility: Can be used for several urgent demands.

No Collateral Required: Many unexpected emergency loans are unsecured.

Negatives:

Higher Desire Charges: Some options, like payday loans, come with steep premiums.

Danger of Credit card debt: Mismanagement from the financial loan can result in money strain.

Tricks for Utilizing an Unexpected emergency Loan Properly

Borrow Only What You would like: Stay away from having out greater than you may afford to repay.

Realize the Conditions: Carefully go through the financial loan settlement, such as curiosity costs and costs.

Plan for Repayment: Ensure you Possess a repayment prepare to stop supplemental monetary anxiety.

Check out Solutions: Before committing, think about other options, like borrowing from loved ones or negotiating with creditors.

Conclusion

Emergency loans can offer much-needed relief during difficult occasions, providing A fast and effortless way to deal with unpredicted charges. By knowledge the categories of loans accessible and borrowing responsibly, you can navigate financial crises with confidence and relief. Always Examine your choices very carefully and select a loan that most closely fits your needs and financial problem.

Check out more details here: 소액결제현금화

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Sam Woods Then & Now!

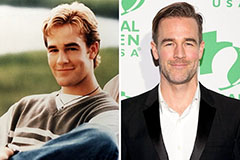

Sam Woods Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!